Calculate the Following (Weightage 5 Marks)

1. Partnership Final Account

1. Undervaluation of Closing Stock by 10%. Closing Stock was ` 30,000 find out the value of Closing Stock

Solution :

Stock are undervalued by 10%

∴ Revised Value = Book value ÷ (100 – % of Undervaluation) x 100

= 30,000 ÷ (100 – 10) x 100

= Rs 33,333

∴ Valuation of Closing Stock = Rs 33,333.

2. Calculate 12.5% P. A. depreciation on Furniture –

a) on Rs 220,000 for 1 year

b) on Rs 10,000 for 6 months

Solution :

Depreciation = Amount of Asset x Period x Depreciation Percentage

(a) = 2,20,000 x 1 x 12.5%

= Rs 27,500

(b) = 10,000 x (6/12) x 12.5%

= Rs 625

3. Insurance Premium is paid for the year ending 1st September 2019 Amounted to Rs 1,500. Calculate prepaid insurance assuming that the year ending is 31st March 2019.

Solution :

Insurance is Pre-Paid for 5 Month i.e From 1st April to 31st August.

∴ Prepaid Insurance = (15,000/12) x 5 = Rs 625

Thus Prepaid Insurance Premium Amount = Rs 625.

4. Find out Gross profit / Gross Loss Purchases Rs 30,000, Sales Rs 15,000, Carriage Inward Rs 2,400, Opening Stock Rs 10,000, Purchase Returns Rs 1,000, Closing Stock Rs 36,000.

Solution :

Gross Profit/Gross Loss = Sales + Closing Stock – Opening Stock – [Purchase – Purchase Return] – Carriage Inward

= 15,000 +36,000 – 10,000 -[30,000 – 1,000] – 2,400

= Rs 9,600

5. Borrowed Loan from Bank of Maharashtra Rs 2,00,000 on 1st October 2019 at rate of 15% p.a. Calculate Interest on Bank Loan for the year 2019-20 assuming that the financial year ends on 31st March, every year.

Solution :

∵ Interest is to be calculated for 6 Month i.e from 1st Oct to 31st March

∴ Interset = Loan Amount x Rate x Period

= 2,00,000 x 15% x (6/12)

= Rs 15,000

∴ Interest on loan Rs 2,00,000 for 6 Month = Rs 15,000

2. Not for Profit’ Concern

1. 10 % p.a. Depreciation on Furniture ` 50,000 (for three months)

Solution

10 % p.a. Depreciation on Furniture ₹ 50,000 (for three months)

Depreciation = Cost of Asset × Rate × Period

=50,000 × (10/100) × (3/12)

= ₹ 1250 Depreciation for 3 months

Thus, Depreciation on furniture @10% on ₹ 50,000 for 3 months = ₹ 1250.

2. 12 % p.a. Interest on Bank Loan ` 80,000 for 1 year.

Solution:

12 % p.a. Interest on Bank loan ₹ 80,000 for 1 year.

Interest = (PNR/100) = 80000 x (12/100) = ₹ 9600

Thus, interest on Bank loan ₹ 80,000 for 1 year = ₹ 9600.

3. Opening Stock of Stationery ` 5,000, Purchases Stationery ` 7,000, Outstanding

Stationery Bill ` 12,000, Closing Stock ` 1,000 What is the amount of Stationery

Consumed?

Solution:

To consumption of stationary | ₹ |

Opening stock | 5,000 |

Add: Purchases | 7,000 |

Add: Outstanding stationary bill | 12,000 |

24,000 | |

Less: Closing Stock | 1,000 |

Consumption of stationary | 23,000 |

4. Salary ` 10,000, Outstanding Salary ` 5,000, Calculate the Salary to be debited to Income

and Expenditure Account?

Solution:

Income and expenditure Account

Particulars | Amount ₹ | Amount ₹ | Particulars | Amount ₹ | Amount ₹ | ||

To Salary | 10,000 | ||||||

Add: Outstanding Salary | 5,000 | 15,000 | |||||

5. Library Books ` …………….? Less 10 % Depreciation ` 5,000 = ` 45,000

Solution:

Library Books ₹ 50,000

Less 10 % Depreciation ₹ 5,000 = ₹ 45,000

% | Depreciation (₹) | |

10 | 5000 | |

100 | ? (Cost) | = 50,000 |

3. Admission of Partner

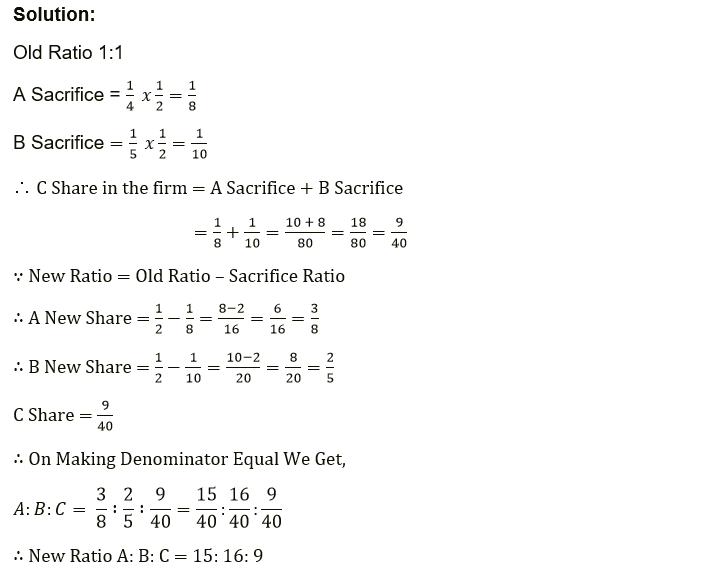

1) A and B are partners in a firm sharing profits and losses in the ratio of 1:1. C is admitted. A surrenders 1/4th share and B surrenders 1/5th of his share in favor of C. Calculate the new profit sharing ratio

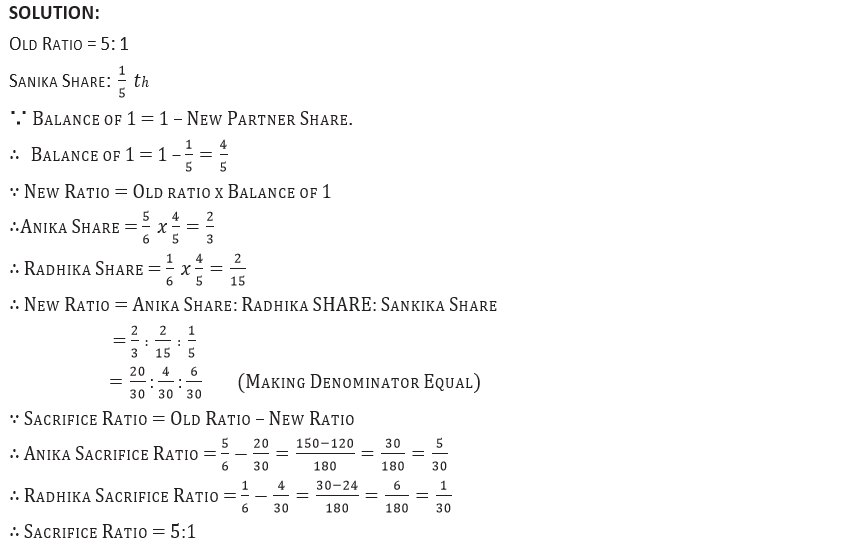

2) Anika and Radhika are partners sharing profits in the ratio of 5:1. They decide to admit Sanika in the firm for 1/5th share. calculate the sacrifice ratio of Anika and Radhika.

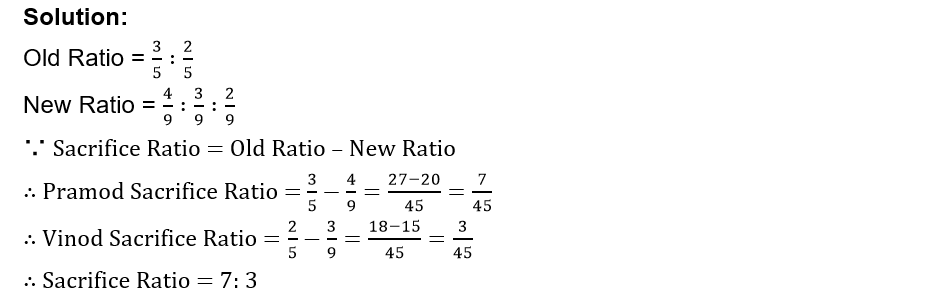

3) Pramod and Vinod are partners sharing profits and losses in the ratio of 3:2. After the admission of Ramesh the new ratio of Pramod, Vinod and Ramesh is 4:3:2. Find out the sacrifice ratio.

4. Retirement of Partner

No Textual Question.

5. Death of Partner

No Textual Question.

6. Dissolution of Partnership Firm

1) Vinod, Vijay, and Vishal are partners in a firm, sharing profit & Losses in the ratio 3:2:1. Vishal becomes insolvent and his capital deficiency is ₹ 6,000. Distribute the capital deficiency among the solvent partners.

SOLUTION

Here, capital deficiency of ₹ 6000 is to be distributed among continuing partners in their profit and loss sharing ratio. i.e. 3:2

Share of deficiency for Vinod = 6,000 x3/5 = ₹ 3,600

Share of deficiency for Vijay = 6,000 ×2/5 = ₹ 2,400

Vinod and Vijay will bear ₹ 3,600 and ₹ 2,400 of Vishal’s capital deficiency.

2) Creditors ₹ 30,000, Bills Payable ₹ 20,000 and Bank Loan ₹ 10,000. Available Bank Balance ₹ 40,000 what will be the amount that creditors will get in case of all partner’s insolvency.

SOLUTION

Ratio of creditors, Bills payable and Bank Loan = 30,000: 10,000: 10,000 i.e., 3: 2: 1

Amount received by creditors = 3/ (3+2+1) ×40000

= 3/6×40000

= ₹ 20,000.

3) Insolvent Partner Capital A/c debit side total is ₹ 10,000 and the credit side total is ₹ 6,000. Calculate deficiency.

SOLUTION

Deficiency of insolvent partner

= Debit side total – Credit side total

= 10,000 – 6,000

= ₹ 4,000.

4) Insolvent partners’ capital A/c Debit side is ₹ 15,000 & insolvent partner brought cash ₹ 6,000. Calculate the amount of Insolvency Loss to be distributed among the solvent partners.

SOLUTION

₹ 9,000 (15,000 – 6,000) is the amount of insolvency loss to be distributed among the solvent partners.

5) Realisation profit of a firm is ₹ 6,000, partners share Profit & Loss in the ratio of 3: 2: 1. Calculate the amount of Realisation Profit to be credited to Partners Capital A/c.

SOLUTION

Distribution of ₹ 6,000 in 3: 2: 1 ratio

6000 × 3/6 = ₹ 3,000

6000 × 2/6 = ₹ 2000

6000 × 1/6 = ₹ 1000

Amount of realisation profit ₹ 3,000, ₹ 2,000 and ₹ 1,000 is to be credited to Partner’s Capital A/c respectively.

7. Bills of Exchange

1) Ganesh draws a bill for ₹ 40,260 on 15th Jan. 2020 for 50 days. He discounted the bill with Bank of India @15% p.a. on the same day. Calculate the amount of discount.

Solution:

Discount = Amount of Bill × (Rate/100) × (Unexpired days/366)

∴ Discount = 40260 × (15/100) × (50/366)

∴ Discount = ₹ 825

(Note: 2020 is a Leap year, so total number of days = 366 days)

2) Shefali Traders drew a bill on Maya for ₹ 30,000 on 1st Oct. 2019 payable after 3 months. Calculate amount of discount in the following cases:

i) Shefali Traders discounted the bill on the same day @ 12% p.a.

ii) Shefali Traders discounted the bill on 1st 2019 @ 12% p.a.

iii) Shefali Traders discounted the bill on 1st Dec. 2019 @ 12% p.a.

Solution:

Discount = Amount of Bill × (Rate/100) × (Unexpired days/366)

(i) Discount = 30000 × (12/100) × (3/12) = ₹ 900

(ii) Discount = 30000 × (12/100) × (2/12) = ₹ 600

(iii) Discount = 30000 × (12/100) × (1/12) = ₹ 300

3) Veena who had accepted Sudha’s bill for ₹ 28,000 was declared bankrupt and only 35 paise in a rupee could be recovered from her estate. Calculate the amount of bad debts.

Solution:

From Veena, only 35 paise in a rupee could be recovered i.e. 65 paise in a rupee is bad debts for Sudha.

So 65 % of ₹ 28,000

= ₹ 18,200 is the amount of bad debts.

4) Nitin renewed his acceptance for ₹ 72,000 by paying ₹ 22,000 in cash and accepting a new bill for the balance plus interest @ 18% p.a. for 4 months. Calculate the amount of new bill.

Solution:

For Nitin, Total outstanding | ₹ 72,000 |

Nitin paid in cash | ₹ 22,000 |

Remaining dues | ₹ 50,000 |

Now, on this ₹ 50,000 we have to calculate interest @ 18 % for 4 months.

Interest = (PRN)/100

∴ Interest = 50000 × (18/100) × (4/12)

∴ Interest = ₹ 3,000

So, amount of new bill = Remaining dues + Interest

= 50,000 + 3,000

= ₹ 53,000.

5) Nisha’s acceptance for ₹ 16,850 sent to bank for collection was honoured and bank charges debited were ₹ 125. Find out the amount actually received by Drawer.

Solution:

Bill of ₹ 16,850 sent to bank for collection and it is honoured and bank charges = ₹ 125

So, actual amount received by drawer = 16,850 – 125

= ₹ 16,725.

6) A bill of ₹16,000 was drawn by Keshav on Gopal on 12th June 2019 for 2 months. What will be the due date, if all of sudden, the legal due date is declared as an emergency holiday?

Solution:

Consider immediate or next working day as due date in case the legal due date is declared as emergency holiday.

i.e. Here, it is 12th June, 2019 | 12/06/2019 | |

+ 2 months | + | 2 |

+ 3 days of grace | + | 3 |

15/08/2019 | ||

∴ Legal due date is 16th August 2019 (Next day).

8. Company Accounts – Issue of Shares

1) One shareholder holding 500 equity shares paid share application money @ ₹ 3 Allotment money @ ₹ 4 per share and failed to pay final call of ₹ 3 per share, his shares were forfeited. Calculate the amount of share forfeiture.

Solution:

Amount of forfeiture = Amount received by company (In case of non-payment of ‘calls’)

Here, shareholder paid ₹ 3 per share on application and ₹ 4 per share on allotment on 500 shares. So, total amount received by company.

= 500 × ₹ 3 + 500 × ₹ 4

= 1,500 + 2,000

= ₹ 3,500.

∴ Amount of share forfeiture = ₹ 3,500.

2) 10000 equity shares of ₹ 10 each issued at 10% premium. Calculate the total amount of share premium.

Solution:

Equity shares = 10,000

Face value = ₹ 10 per share

Premium @ 10 % = 10,000 × 10 × (10/100) = ₹ 10,000.

So, premium 10,000 shares of ₹ 10 each at 10 % = ₹ 10,000.

3) Company received an excess application for 5000 shares @ ₹4 per share. Applications of 1000 shares were rejected and a pro-rata allotment was made. Calculated the amount of application money adjusted with allotment.

Solution:

Excess application money received for 5000 shares @ ₹ 4 per share | = ₹ 20,000 |

Less: Application of 1000 shares rejected and money refunded | = ₹ 4,000 |

Excess money received to be adjusted with allotment | ₹ 16,000 |

4) 80000 Equity shares of ₹ 10 each issued and fully subscribed and called up at 20% premium. Calculate the amount of Equity share Capital.

Solution:

Equity Share capital = No. of equity shares × face value of each share

= 80,000 × ₹ 10

= ₹ 8,00,000

Note: Equity Share capital has no concern with premium or discount amount.

5) Directors issued 20000 equity shares of ₹ 100 each at par. These were fully subscribed and called up. All money received except one shareholder holding 100 equity shares failed to pay final call of ₹ 20 per share. Calculate the amount of paid-up capital of the company.

Solution:

Fully subscribed and called-up amount = 20,000 equity shares × ₹ 100 each share

= ₹ 20,00,000

But one shareholder failed to pay final call of ₹ 20 per share of 100 equity shares means Non-payment of shares = 100 equity shares × ₹ 20 per share = ₹ 2,000

∴ Total Paid-up capital amount = ₹ 20,00,000 – ₹ 2,000

= ₹ 19,98,000

6) Company sends Regret letter for 100 shares and Allotment letter to 25000 shareholders. Application money was ₹ 20 per share. Calculate the amount of application money which company is refunding.

Solution:

Company send Regret letter for 100 shares for ₹ 20 per share application money received

i.e. only that much amount company will refund.

Amount of refund = No. of shares × Value of per share

= 100 × ₹ 20

= ₹ 2,000

9. Analysis of Financial Statements

No Textual Question.

10. Computer In Accounting

No Textual Question.