Practical Problem 02

Practical Problems | Q 2 | Page 202

2. Rahul, Rohit AND Ramesh are in A business Sharing profits and losses in the Ratio of 3:2:1 respectively. | |||

Their Balance Sheet AS on 31st MARch 2017 WAS AS follows. | |||

Balance Sheet as on 31st March 2017 | |||

Liabilities | Amt | Assets | Amt |

Capital Account : | Debtors 1,00,000 | ||

Rahul | 2,20,000 | Less: R. D. D. (10,000) | 90,000 |

Rohit | 2,10,000 | Plant and Machinery | 85,000 |

Ramesh | 2,40,000 | Investment | 3,50,000 |

creditors | 80,000 | Motor lorry | 1,00,000 |

Bills Payable | 7,000 | Building | 80,000 |

General Reserve | 96,000 | Bank | 1,48,000 |

8,53,000 |

| 8,53,000 | |

On 1st October 2017 RAMESH died AND the PARTNERSHIP deed provided THAT | |||

1) R.D.D. WAS MAINTAINED AT 5% on Debtors | |||

2. PLANT AND MACHINERY AND Investment were VALUED AT ` 80,000 AND ` 4,10,000 respectively. | |||

3. Of the creditors AN item of ` 6000 WAS no longer A LIABILITY AND hence WAS properly ADJUSTED. | |||

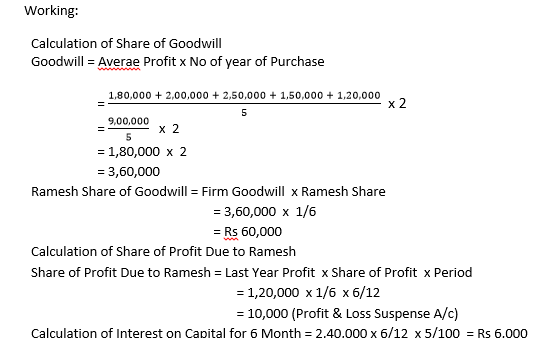

4. Profit for 2017-18 WAS ESTIMATED AT `120,000 AND RAMESH SHARE in it up to the DATE of his DEATH | |||

WAS given to him. | |||

5. Goodwill of the Firm WAS VALUED AT two times the AVERAGE profit of the LAST five YEARS. Which | |||

were 2012-13 Rs1,80,000, 2013-14 Rs2,00,000, 2014-15 Rs 2,50,000 | |||

2015-16 Rs1,50,000 2016-2017 Rs 1,20,000 | |||

RAMESH SHARE in it WAS to be given to him | |||

6. SALARY 5,000 p.m. WAS PAYABLE to him | |||

7. Interest on CAPITAL AT 5% i.e. WAS PAYABLE AND on DRAWINGS ` 2000 were Charged. | |||

8. DRAWINGS MADE by RAMESH up to September 2017 were `5,000 p.m. | |||

Prepare Ramesh’s Capital A/c showing the amount payable to his executors | |||

Give Working of Profit and Goodwill | |||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||