Practical Problem 03

Practical Problems | Q 3 | Page 203

Ram, Madhav AND Keshav are Partners Sharing Profit AND Losses in the respectively. | |||||||||||||||||||||||||||||||||||||||||||

Their Balance Sheet AS on 31st March 2018 WAS AS follows. | |||||||||||||||||||||||||||||||||||||||||||

BALANCE Sheet AS on 31st March 2018 | |||||||||||||||||||||||||||||||||||||||||||

Liabilities | Amt ` | Assets | Amt ` | ||||||||||||||||||||||||||||||||||||||||

General Reserve | 25,000 | Goodwill | 50,000 | ||||||||||||||||||||||||||||||||||||||||

Creditors | 1,00,000 | Loose Tools | 50,000 | ||||||||||||||||||||||||||||||||||||||||

Unpaid Rent | 25,000 | Debtor | 1,50,000 | ||||||||||||||||||||||||||||||||||||||||

Capital Accounts | Live Stock | 1,00,000 | |||||||||||||||||||||||||||||||||||||||||

Ram | 1,00,000 | Cash | 25,000 | ||||||||||||||||||||||||||||||||||||||||

Madhav | 75,000 | ||||||||||||||||||||||||||||||||||||||||||

Keshav | 50,000 | ||||||||||||||||||||||||||||||||||||||||||

3,75,000 |

| 3,75,000 | |||||||||||||||||||||||||||||||||||||||||

KESHAV died on 31st July 2018 AND the following Adjustment were Agreed by AS per partnership deed. | |||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||

In the books of the partnership Firm | |||

Dr Revaluation A/c Cr | |||

Particulars | Amount | Particulars | Amount |

To R.D.D A/c | 10,000 | By Loose Tools A/c | 30,000 |

To Creditors A/c | 10,000 | By Live Stock A/c | 20,000 |

To Partners Capital A/c (Profit) | |||

Ram 15,000 | |||

Madhav 9,000 | |||

Keshav 6,000 | 30,000 | ||

50,000 | 50,000 | ||

Dr Keshav’s Capital A/c Cr | |||

Particulars | Amount | Particulars | Amount |

To Balance c/d | 92,000 | By Bal b/d | 50,000 |

By General Reserve A/c | 5,000 | ||

By Commission A/c (2,000 x 4 Month) | 8,000 | ||

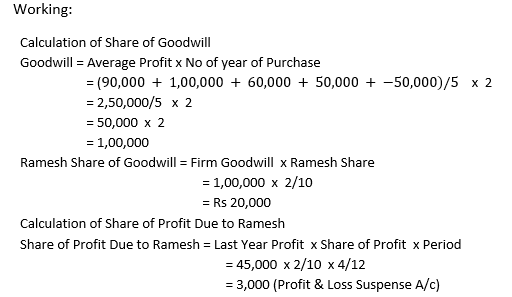

By Goodwill A/c | 20,000 | ||

By Revaluation A/c (Profit) | 6,000 | ||

By Profit & Loss Suspense A/c | 3,000 | ||

92,000 | 92,000 | ||