Practical Problem 04

IN THE BOOKS OF NEW FIRM | |||||

Dr Profit and Loss Adjustment Account Cr | |||||

Particular | Amt | Amt | Particular | Amt | Amt |

To Sundry Debtors | 1,600 | By Stock | 1,000 | ||

To Furniture A/c | 2,200 | By Land & Building | 3,200 | ||

To Profit On Revaluation: | |||||

Deep Capital A/c | 300 | ||||

Karan Capital A/c | 100 | 400 | |||

4,200 | 4,200 | ||||

Dr Partners Capital A/c Cr | |||||||

Particular | Deep | Karan | Shubham | Particular | Deep | Karan | Shubham |

By Bal b/d | 60,000 | 20,000 | |||||

By Gen Res A/c | 6,000 | 2,000 | |||||

To Cash A/c | 13,800 | 4,600 | By Cash A/c | 20,000 | |||

To Bal c/d | 60,000 | 20,000 | 20,000 | By Goodwill A/c | 7,500 | 2,500 | |

By P&L Adj A/c | 300 | 100 | |||||

73,800 | 24,600 | 20,000 | 73,800 | 24,600 | 20,000 | ||

Balance sheet of New Firm as on 1st April…. | |||||

Liabilities | Amt | Amt | Asset |

| Amt |

Capital A/c | Land & Building | 16,000 | |||

Deep | 60,000 | Add: Appreciation @ 20% | 3,200 | 19,200 | |

Karan | 20,000 | Plant and machinery | 30,000 | ||

Shubham | 20,000 | 1,00,000 | |||

Sundry Creditor | 40,000 | Furniture | 11,000 | ||

Bill Payable | 10,000 | Less Depreciation @ 20% | -2,200 | 8,800 | |

Bank Overdraft | 11,000 | Sundry debtors | 32,000 | ||

Less R.D.D @5% | -1,600 | 30,400 | |||

Stock | 20,000 | ||||

Add: Appreciation | 1000 | 21,000 | |||

Cash A/c | 51,600 | ||||

1,61,000 | 1,61,000 | ||||

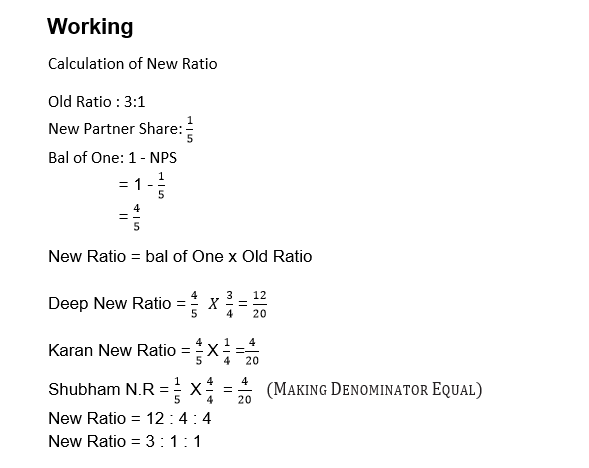

Working:

Dr Cash A/c Cr | |||||

Particular | Amt | Amt | Particular | Amt | Amt |

To Bal b/d | 40,000 | By Deep Capital A/c | 13,800 | ||

TO Shubham Capital A/c | 20,000 | By Karan Capital A/c | 4,600 | 18,400 | |

To Goodwill A/c | 10,000 | ||||

By Bal c/d | 51,600 | ||||

70,000 | 70,000 | ||||

Dr Goodwill A/c Cr | |||||

Particular | Amt | Amt | Particular | Amt | Amt |

To Deep Capital A/c | 7,500 | By Cash | 10,000 | ||

To Karan Capital A/c | 2,500 | 10,000 | |||

10,000 | 10,000 | ||||