Practical Problem 09

IN THE BOOKS OF NEW FIRM | |||||

Dr Profit and Loss Adjustment Account Cr | |||||

Particular | Amount | Amount | Particular | Amount | Amount |

To Furniture | 400 | BY Land & Building | 10,000 | ||

To Debtors | 800 | By Stock A/c | 10,000 | ||

To Profit on Revaluation | |||||

Amit Capital A/c | 7,520 | ||||

Baban capital A/c | 11,280 | 18,800 | |||

20,000 | 20,000 | ||||

Dr Partner Capital A/c Cr | |||||||

Particular | Amit | Baban | Kamal | Particular | Amit | Baban | Kamal |

By Bal b/d | 1,00,000 | 1,00,000 | |||||

To Loan A/c | 63,520 | 45,280 | By Cash A/c | 50,000 | |||

To Bal c/d | 60,000 | 90,000 | 50,000 | By Goodwill A/c | 16,000 | 24,000 | |

By P & L Adj A/c | 7,520 | 11,280 | |||||

1,23,520 | 1,35,280 | 50,000 | 1,23,520 | 1,35,280 | 50,000 | ||

Balance sheet of New Firm as on 1st April 2018. | |||||

Liabilities | Amount | Amount | Asset | Amount | Amount |

Capital A/c | Land and Building | 50,000 | |||

Amit | 60,000 | Add: Appreciation | 10,000 | 60,000 | |

Bban | 90,000 | Plant | 60,000 | ||

Kamal | 50,000 | 2,00,000 | Furniture | 4,000 | |

Creditors | 1,40,000 | Less: Dep @ 10% | -400 | 3,600 | |

Amit Loan | 63,520 | Stock | 1,00,000 | ||

Baban Loan | 45,280 | Add: Appreciation | 10,000 | 1,10,000 | |

Debtors | 16,000 | ||||

Less RDD @ 5% | -800 | 15,200 | |||

Cash | 2,00,000 | ||||

4,48,800 | 4,48,800 | ||||

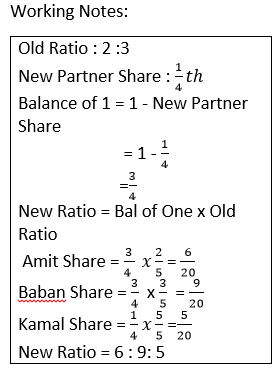

Working:

Dr Cash A/c Cr | |||||

Particular | Amount | Amount | Particular | Amount | Amount |

To Bal b/d | 1,10,000 | ||||

To Kamal Capital A/c | 50,000 | By Bal c/d | 2,00,000 | ||

To Goodwill A/c | 40,000 | ||||

2,00,000 | 2,00,000 | ||||

Dr Goodwill A/c Cr | ||||||

Particular | Amount | Amount | Particular | Amount | Amount | |

To Amit Capital A/c | 16,000 | By Cash | 40,000 | |||

To Baban Capital A/c | 24,000 | 40,000 | ||||

40,000 | 40,000 | |||||